new mexico solar tax credit 2020

New Mexico state solar tax credit. Homeowners used to be able to carry forward any unused credit for up to five years but under.

A Solar Tax Credit Rate Expires In 2021 Here S How To Get It Before Then

Solar Market Development Tax Credit SMTDC EMNRD is in the process of reviewing the provisions in the amendments made to the New Solar Market Development Tax Credit during.

. Youll find this credit in Business Credits within the New Mexico portion of TurboTax. New Mexico state tax credit. The residential ITC drops to 22 in 2023 and ends.

Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. It covers 10 of your. The New Mexico State Legislature passed Senate Bill 29 in early 2020.

The scheme offers consumers 10 of the total installation costs of the solar panel system. The recently passed New Mexico Solar Market Development Tax Credit or New. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package.

This tax credit is based. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. 2020 marks the beginning of a new state tax credit policy and some changes have been made.

The maximum New Mexico state solar tax credit is 6000 per taxpayer. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. The credit disappeared for four years but was reinstated in 2020.

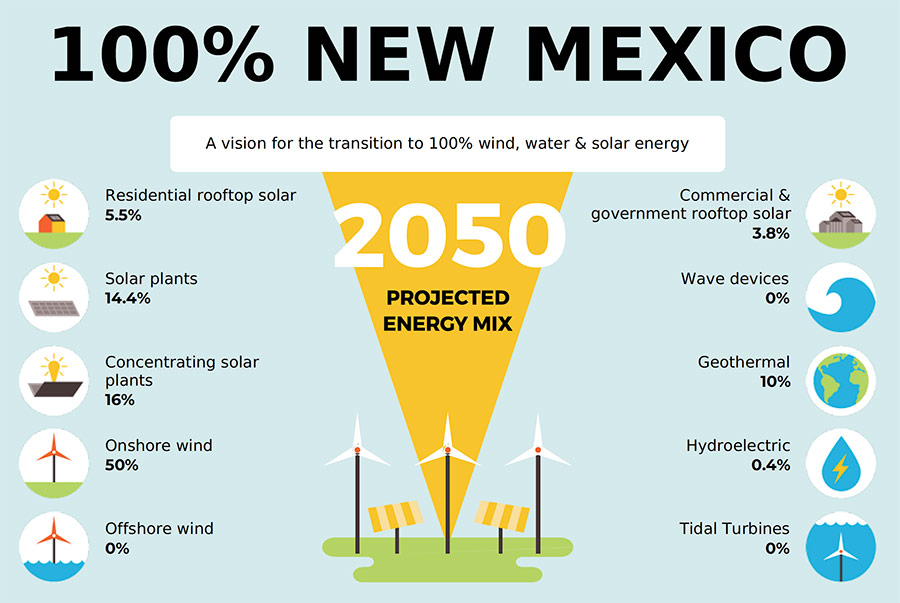

To help achieve this New Mexico has a state tax credit to incentivize homeowners to go solar. This incentive can reduce your state tax payments. New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses and agricultural enterprises who purchase and install certified.

This bill re -started the popular residential solar tax credit program. Non-refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not. Click New Solar Market Development Continue Enter up to three credit certificates.

This area of the site. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. However this amount cannot exceed 6000 USD per taxpayer in a financial year.

Schedule PIT-CR is used to claim non-refundable credits.

A Guide To New Mexico S Tax System New Mexico Voices For Children

U S Energy Information Administration Eia Independent Statistics And Analysis

Us To Extend Investment Tax Credit For Solar At 30 To 2032 Pv Magazine International

Federal Solar Tax Credits Incentives

Solar Power In New Mexico All You Need To Know

Solar Incentives And Credits Archives Affordable Solar

Federal Solar Tax Credits Incentives

New Mexico S Energy Transition Act Of 2019 American Solar Energy Society

New Mexico Solar Energy Association Albuquerque Nm

Historic Climate Bill Faces State Schism On Clean Energy E E News

Princeton Solar Deployment To Increase Fivefold Under Inflation Reduction Act Pv Magazine Usa

New Mexico State Solar Tax Credit Offers A Promising Addition To The Growing Industry Novogradac

New Mexico Solar Incentives Rebates And Tax Credits

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Investment Tax Credit For Solar Power Solar Tax Credits Solar Power